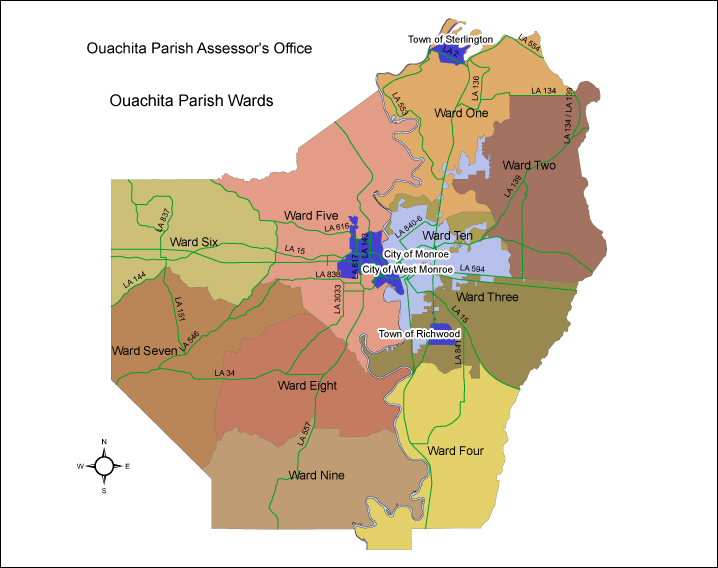

Ouachita Parish Ward Map

Current Ward Map (derived from Census 2000 data)

Current Ward Map (derived from Census 2000 data)

The information contained on this page was compiled solely for use by the Ouachita Parish Assessor's Office, the Louisiana Tax Commission and/or the Louisiana Legislative Auditor. The Ouachita Parish Assessor's Office assumes no liability for the improper use or alteration of this data for other purposes.

There are several types of reports produced by our office each tax year, some of which are mandated by the Louisiana Tax Commission. The reports below are in PDF format. If you do not have the Adobe Acrobat Reader, you may get it here.

This report details the taxes that are collectible for each individual taxing body on a tax roll. This includes the amount of taxes that are exempted by Homestead. Some summary data about the tax roll is also included.

This report summarizes assessed property values throughout the parish according to classification. It also provides totals for types of property such as Real Estate, Personal Property, etc.

Here is some information about our current taxing bodies and their associated millage rates.

Below you will find a list of charts and graphs displaying information about taxes and values in Ouachita Parish.

For a quick and easy way to estimate your taxes try the free tax calculator. Please note that the correctness of the tax information provided is not warranted. Actual taxes may only be determined at the time the books are closed and the tax roll is printed.

Tax CalculatorAlthough our office strives to ensure the accuracy and authenticity of this information, this information is provided for your convenience only. This information is given without recourse or warranty, and should not be relied upon for any legal purpose, including, but not limited to ownership, tax consequences, flood status, or any other purpose.